How to Read Your Property Tax Bill

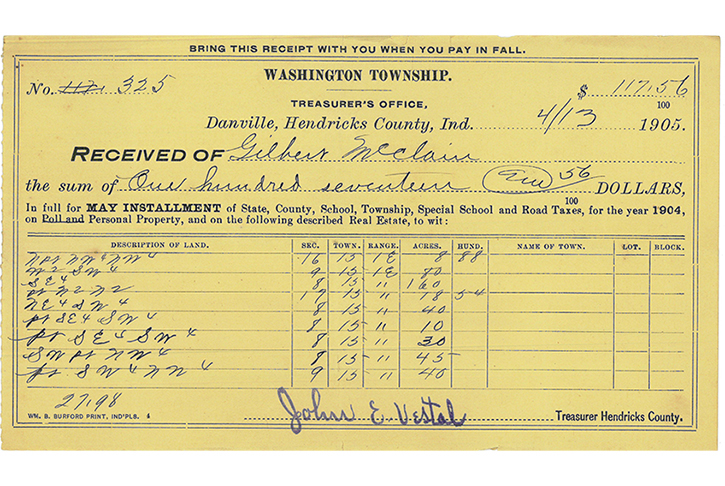

Property taxes in Indiana are paid in two installments, due May 10 and November 10 of each year. We are fast approaching the due date for the spring installment, and property owners already have their property tax bills in hand. Property tax bills in Indiana used to contain little information other than what was absolutely necessary. But today’s property tax bills contain a wealth of information about the property owner’s local governments, from the individual unit tax rates to itemized deductions, if applicable, to the property type. Knowing how to read a property tax bill allows property owners to better understand how the property tax system works and how much they are paying to each individual government unit. For more information on how to read your property tax bill, watch this Purdue Extension video.