Rural Indiana Stats Website

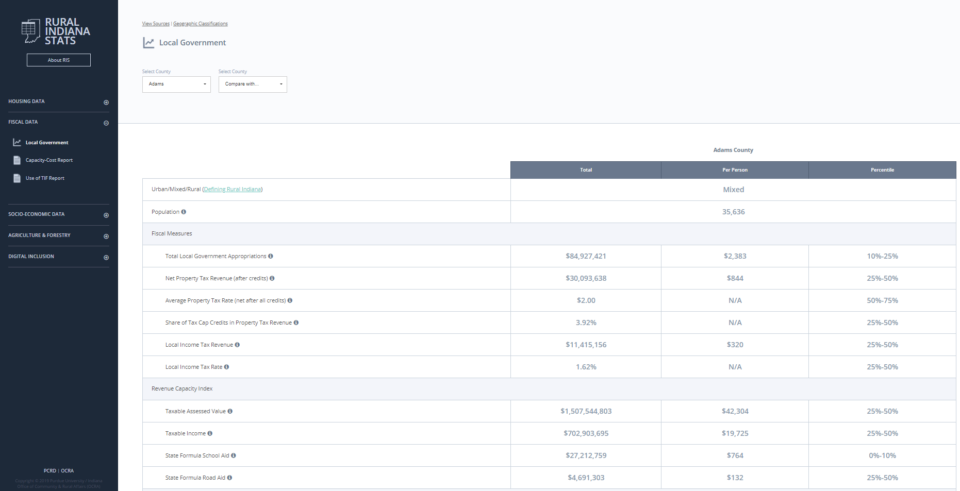

When you’re looking to make data-driven decisions for local government financing, don’t overlook a great tool from the Purdue Center for Regional Development (PCRD): Rural Indiana Stats. This site features a capacity-cost index, calculated by Dr. Larry DeBoer, that helps everyone from local residents to local elected officials understand what resources are available to them and at what rate.

According to DeBoer’s 2020 report, which can be accessed via the website, the fiscal conditions of Indiana local governments depend on the availability of taxable property and income, on state aid formulas, and on the costs of providing services. Revenue capacity and service costs can be measured independently of any budget or tax decisions made by local officials. The difference between the two—a “capacity-cost index” –can show the conditions under which local tax and service decisions are made.

By searching any one of Indiana’s 92 counties, you can view that county’s unique capacity-cost calculation (conducted by DeBoer), which is simply revenue capacity minus service cost. If the capacity-cost index is positive, the local governments in a county can support an average level of appropriations with average tax rates and existing state aid. The county would have the option of providing an average service level with lower tax rates, or to appropriate more than average for services at average tax rates. If the capacity-cost index is negative, however, local governments in a county cannot support an average level of appropriations with average tax rates and existing state aid. The local governments would have to charge higher than average tax rates to provide average service levels or use average tax rates to provide lower than average service levels.

Understanding whether your county is “positive” or “negative” in the capacity-cost index can give you some valuable insight for objective decision-making that transcends political agendas. To explore PCRD’s local government fiscal data, use this link: https://pcrd.purdue.edu/ruralindianastats/fiscal/local-government.php?county=Adams.